APYX MEDICAL CORPORATION REPORTS THIRD QUARTER 2025 FINANCIAL RESULTS

- Initiated full U.S. commercial launch of AYON Body Contouring System™ (AYON) at end of Q3 2025, with demand for pre-orders exceeding expectations

- Submitted new 510(k) for AYON for device label expansion to include power liposuction

- Increased total revenue guidance for FY2025 to a range of $50.5 million to $52.5 million

- Management to host a conference call today at 8:00 a.m. ET

CLEARWATER, FL — November 6, 2025 – Apyx® Medical Corporation (NASDAQ:APYX) (“Apyx Medical;” the “Company”), the leader in surgical aesthetics marketed and sold as Renuvion® and the AYON Body Contouring System™ (AYON), today reported financial results for its quarter ended September 30, 2025.

Recent Financial and Operating Highlights:

- Reported total revenue of $12.9 million in the third quarter of 2025, compared to $11.5 million in the comparable period last year.

- Surgical Aesthetics revenue increased to $11.1 million in the third quarter of 2025, compared to $9.3 million in the third quarter of 2024 and increased over 30% in the U.S.

- OEM revenue was approximately $1.8 million in the third quarter of 2025, representing a decrease of 18% from the same period last year.

- Net loss attributable to stockholders of $2.0 million in the third quarter of 2025, compared with a net loss attributable to stockholders of $4.7 million in the third quarter of 2024.

- Adjusted EBITDA loss decreased 96%, to $0.1 million for the third quarter of 2025, compared with $2.4 million for the third quarter of 2024.

- Launched commercial sales of AYON across the U.S. in September 2025; with customer demand exceeding expectations. AYON, which received 510(k) clearance from the U.S. Food and Drug Administration (the “FDA”) in May 2025, is an all-in-one system that integrates advanced modalities to perform multiple functions seamlessly, removing unwanted fat, enhancing tissue contraction and addressing the full range of patient needs from contouring to aesthetic enhancement.

- Submitted a new 510(k) premarket notification to the FDA in October 2025 for the label expansion of the AYON to include power liposuction. Pending regulatory clearance, surgeons will be able to address every aspect of contouring within one platform, streamlining workflow, and potentially enhancing outcomes, and AYON will be positioned as the new gold standard in surgical aesthetics.

- Management hosted a virtual key opinion leader event to discuss the commercial launch of the AYON, featuring Paul Vanek, Jr., MD, FACS, Founder, President & CEO, Mentor Plastic Surgery & MedSpa, on October 14th.

“In September, we successfully transitioned the commercialization program for AYON from an effective soft launch targeting key regions to a full U.S. program. Initial feedback from leading board-certified plastic and cosmetic surgeons continues to be overwhelmingly positive, with several of them contributing at workshops and clinical symposia that drove strong engagement and resulted in pre-orders for the AYON. While we are still in the early stages of ramping up the broader commercial program, I am excited to announce that we reported a 19% increase in Surgical Aesthetics revenue for the third quarter of 2025,” said Charlie Goodwin, President and Chief Executive Officer.

“Looking ahead, we plan to continue accelerating the adoption of AYON and expanding its user base, which will drive single-use handpiece sales growth. Anticipated demand will be driven, in part, by the pending FDA clearance of the 510(k) premarket notification submitted last month for the label expansion of the AYON to include power liposuction. Upon receiving this market clearance, we will be able to activate this new functionality in the AYON systems already installed at surgical centers across the U.S. through the ongoing commercial launch,” concluded Mr. Goodwin.

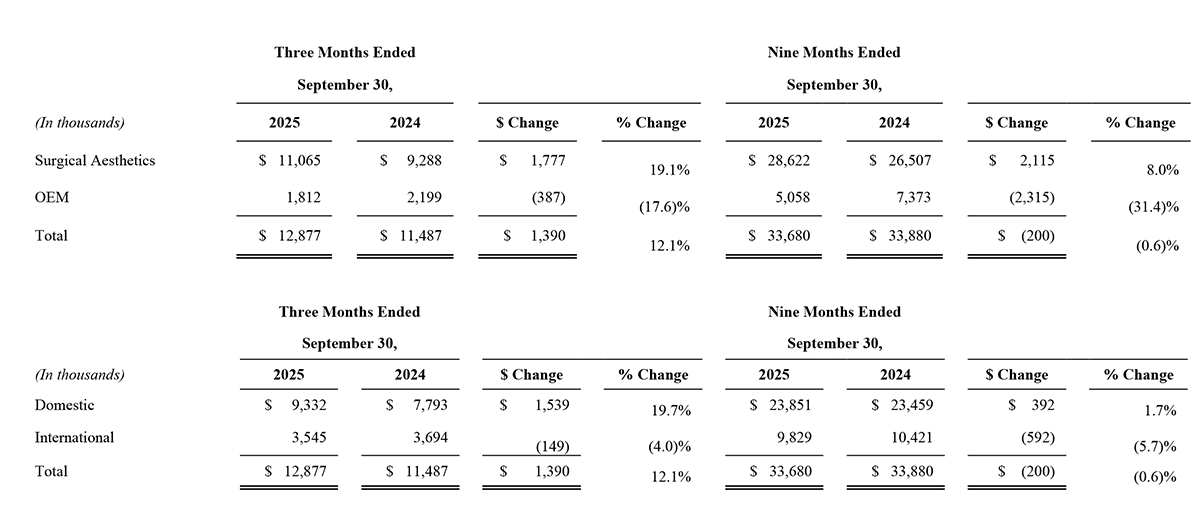

The following tables present revenue by reportable segment and geography:

Third Quarter 2025 Results:

Total revenue for the three months ended September 30, 2025 increased to $12.9 million, compared to $11.5 million in the prior year period. Surgical Aesthetics segment sales increased 19% or $1.8 million to approximately $11.1 million for the three months ended September 30, 2025, when compared with $9.3 million for the three months ended September 30, 2024. The Surgical Aesthetics sales increase was driven by sales of AYON, as the Company commenced its commercial launch during the quarter, and increased volume of single-use handpieces in both domestic and international markets. These increases were partially offset by decreases in domestic sales of generators, including upgrades to the Apyx One Console, where the purchase of AYON was not part of the sale, and upgrades to the Apyx One Console in international markets. Overall, domestic Surgical Aesthetics sales increased by over 30% from the prior year period. OEM segment sales decreased 18%, or approximately $0.4 million, to $1.8 million for the three months ended September 30, 2025 when compared with $2.2 million for the three months ended September 30, 2024. The decrease in OEM sales was due to decreases in sales volume to existing customers, including Symmetry Surgical under our 10-year generator manufacturing and supply agreement.

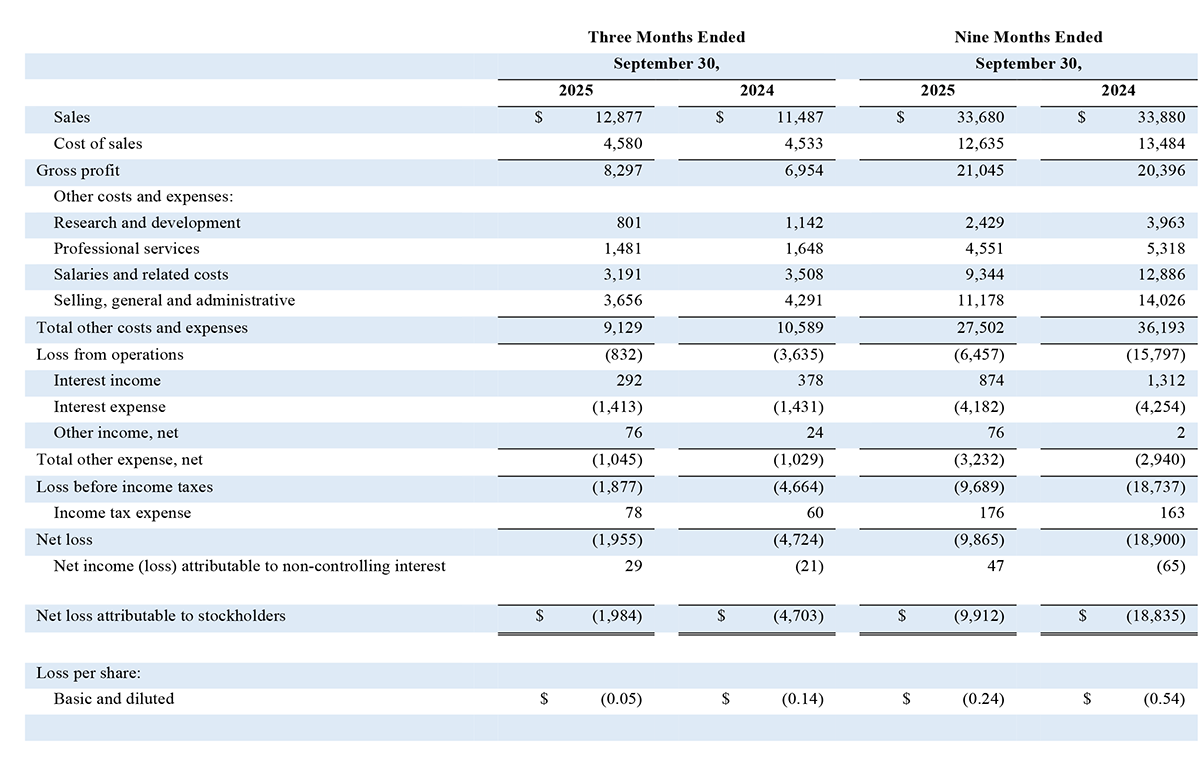

Gross profit for the three months ended September 30, 2025, increased to $8.3 million, compared to $7.0 million for the same period in the prior year. Gross margin for the three months ended September 30, 2025, was 64.4%, compared to 60.5% for the prior year period. The increase in gross margin for the three months ended September 30, 2025 from the prior year period is primarily attributable to mix between our segments with Surgical Aesthetics comprising a higher percentage of total sales, geographic mix, with domestic sales comprising a higher percentage of total sales and product mix within our OEM segment. These increases were partially offset by changes in product mix within our Surgical Aesthetics segment.

Operating expenses decreased $1.5 million to $9.1 million for the three months ended September 30, 2025, compared with $10.6 million in the prior year period. The decrease in operating expenses was driven by a $0.6 million decrease in selling, general and administrative expenses, a $0.3 million decrease in research and development expenses, a $0.3 million decrease in salaries and related costs, and a $0.2 million decrease in professional services expenses.

Other expense, net for the three-month periods ended September 30, 2025 and 2024, was flat at $1.0 million.

Income tax expense was $78,000 for the three months ended September 30, 2025, compared with $60,000 for the prior year period.

Net loss attributable to stockholders was $2.0 million, or $0.05 per share, for the three months ended September 30, 2025, compared with $4.7 million, or $0.14 per share, in the prior year period.

Adjusted EBITDA loss for the three-month periods ended September 30, 2025 and 2024 was $0.1 million and $2.4 million, respectively.

Financial Guidance for Full Year 2025:

The Company announced an upward revision to select financial guidance targets for the year ending December 31, 2025:

- Total revenue in the range of $50.5 million to $52.5 million, up from the previous guidance range of $50.0 million to $52.0 million; and up compared to the original full year 2025 guidance of $47.6 million to $49.5 million. This is compared to the $48.1 million reported for the year ended December 31, 2024.

- Total revenue guidance assumes:

- Surgical Aesthetics revenue is expected to be in the range of $43.0 million to $45.0 million, up from the previous guidance of $42.0 million to $44.0 million. This is compared to approximately $38.6 million reported for the year ended December 31, 2024.

- OEM revenue is expected to be approximately $7.5 million, down from the previous guidance of $8.0 million. This is compared to approximately $9.5 million for the year ended December 31, 2024.

- The Company expects operating expenses of less than $40.0 million for the year ended December 31, 2025.

- Total revenue guidance assumes:

Conference Call Details:

Management will host a conference call at 8:00 a.m. Eastern Time on November 6, 2025 to discuss the results of the third quarter 2025, and to host a question and answer session. To listen to the call by phone, interested parties may dial 800-717-1738 (or 646-307-1865 for international callers) and provide access code 73607. Participants should ask for the “Apyx Medical Corporation Call”. A live webcast of the call will be accessible via the Investor Relations section of the Company’s website (click here) and accessible directly (click here).

An archive of the webcast will be accessible approximately one hour after the live event ends on the Investor Relations section of the Company’s website (click here).

Investor Relations Contact:

Jeremy Feffer, Managing Director, LifeSci Advisors

OP: 212-915-2568

jfeffer@lifesciadvisors.com

About AYON Body Contouring System™:

AYON is a groundbreaking, surgeon-designed body contouring system that combines precision, versatility, and innovation in an all-in-one platform. It seamlessly integrates fat removal, closed loop contouring, and Renuvion’s tissue contraction and electrosurgical capabilities, empowering surgeons to deliver the most comprehensive body contouring treatments for patients. With advanced features like LIFT Technology for real-time adjustments and Renuvion for enhanced tissue contraction, AYON sets a new standard in surgical care, streamlining procedures and maximizing patient outcomes. Backed by Apyx Medical’s expertise and evidence-based design, AYON delivers consistent, reliable performance and an unmatched return on investment. As the first of its kind, AYON is revolutionizing body contouring and shaping the future of aesthetic surgery. In October 2025, the Company filed an additional 510(k) for the label expansion of AYON to include power liposuction.

About Apyx Medical Corporation:

Apyx Medical Corporation is a surgical aesthetics company with a passion for elevating people’s lives through innovative products, including its Helium Plasma Platform Technology products marketed and sold as Renuvion and now the AYON Body Contouring System™ in the cosmetic surgery market and J-Plasma® in the hospital surgical market. Renuvion and J-Plasma offer surgeons a unique ability to provide controlled heat to tissue to achieve their desired results. The effectiveness of Renuvion and J-Plasma is supported by more than 90 clinical documents. The Company also leverages its deep expertise and decades of experience in unique waveforms through OEM agreements with other medical device manufacturers. For further information about the Company and its products, please refer to the Apyx Medical Corporation website at www.ApyxMedical.com.

Cautionary Statement on Forward-Looking Statements:

Certain matters discussed in this release and oral statements made from time to time by representatives of the Company may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the Federal securities laws. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved.

All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including but not limited to, projections of net revenue, margins, expenses, net earnings, net earnings per share, or other financial items; projections or assumptions concerning the possible receipt by the Company of any regulatory approvals from any government agency or instrumentality including but not limited to the U.S. Food and Drug Administration (the “FDA”), supply chain disruptions, component shortages, manufacturing disruptions or logistics challenges; or macroeconomic or geopolitical matters and the impact of those matters on the Company’s financial performance.

Forward-looking statements and information are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Many of these factors are beyond the Company’s ability to control or predict. Important factors that may cause the Company’s actual results to differ materially and that could impact the Company and the statements contained in this release include but are not limited to risks, uncertainties and assumptions relating to the regulatory environment in which the Company is subject to, including the Company’s ability to gain requisite approvals for its products from the FDA and other governmental and regulatory bodies, both domestically and internationally; sudden or extreme volatility in commodity prices and availability, including supply chain disruptions; changes in general economic, business or demographic conditions or trends; changes in and effects of the geopolitical environment; liabilities and costs which the Company may incur from pending or threatened litigations, claims, disputes or investigations; and other risks that are described in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and the Company’s other filings with the Securities and Exchange Commission. For forward-looking statements in this release, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise.

APYX MEDICAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited) (In thousands, except per share data)

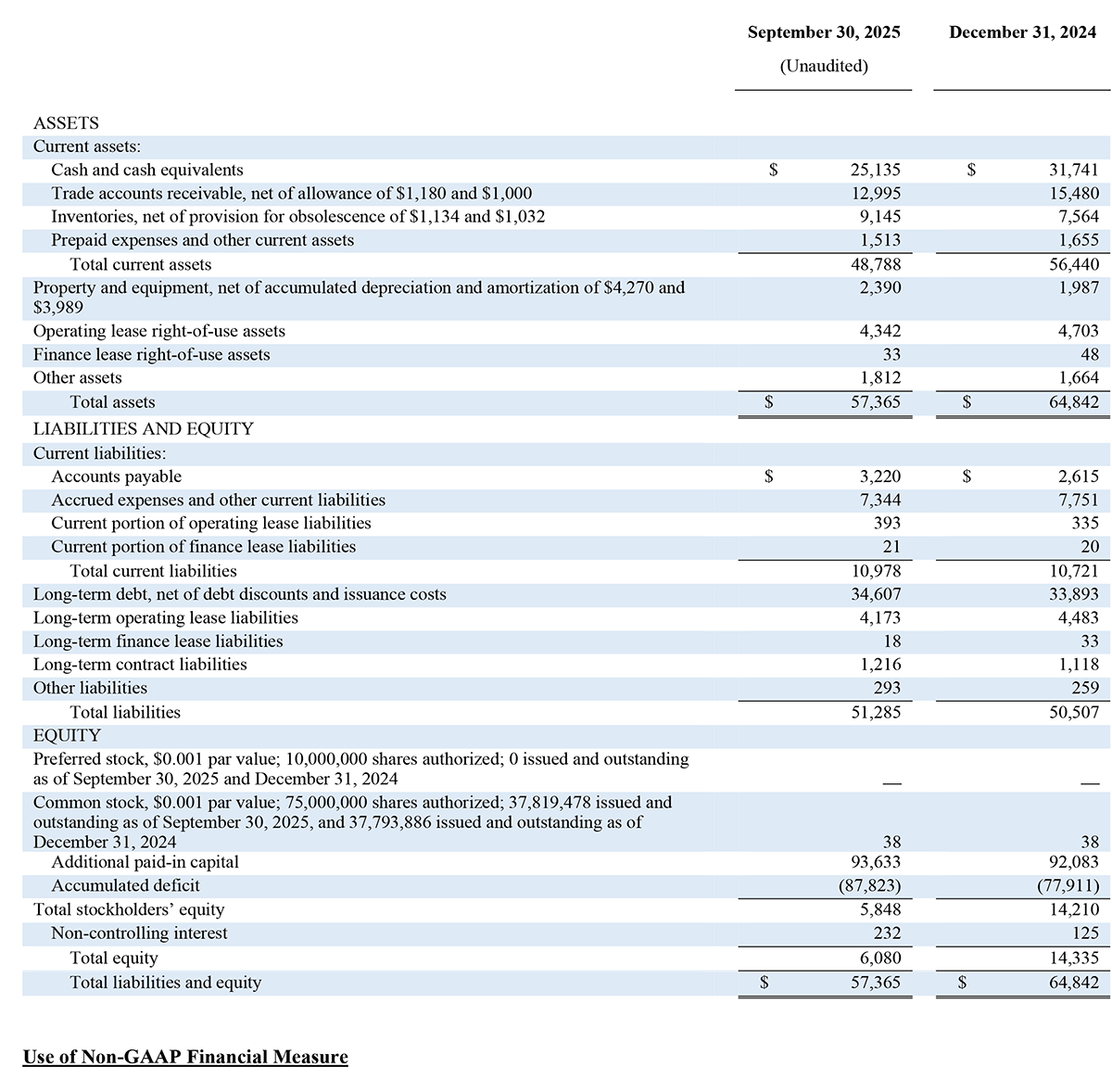

APYX MEDICAL CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data)

The Company has presented the following non-GAAP financial measure in this press release: adjusted EBITDA. The Company defines adjusted EBITDA as its reported net loss attributable to stockholders (GAAP) plus income tax expense (benefit), interest income and expense, depreciation and amortization, stock-based compensation expense and other significant non-recurring items.

The Company has presented the following non-GAAP financial measure in this press release: adjusted EBITDA. The Company defines adjusted EBITDA as its reported net loss attributable to stockholders (GAAP) plus income tax expense (benefit), interest income and expense, depreciation and amortization, stock-based compensation expense and other significant non-recurring items.

We present the following non-GAAP measure of adjusted EBITDA because we believe such measure is a useful indicator of our operating performance. Our management uses adjusted EBITDA principally as a measure of our operating performance and believes that this measure is useful to investors because it is frequently used by analysts, investors and other interested parties to evaluate companies in our industry. We also believe that this measure is useful to our management and investors as a measure of comparative operating performance from period to period. The non-GAAP financial measure presented in this release should not be considered as a substitute for, or preferable to, the measures of financial performance prepared in accordance with GAAP.

APYX MEDICAL CORPORATION

RECONCILIATION OF GAAP NET LOSS TO NON-GAAP ADJUSTED EBITDA

(Unaudited)