APYX MEDICAL CORPORATION REPORTS FIRST QUARTER 2020 FINANCIAL RESULTS

CLEARWATER, FL — MAY 11, 2020 – Apyx™ Medical Corporation (NASDAQ:APYX) (the “Company”), a maker of medical devices and supplies and the developer of Helium Plasma Technology, marketed and sold as Renuvion® in the cosmetic surgery market and J-Plasma® in the hospital surgical market, today reported financial results for its first quarter ended March 31, 2020.

First Quarter 2020 Financial Summary

- Total Q1 revenue of $5.0 million, down 11% year-over-year.

- Advanced Energy revenue of $4.0 million, down 9% year-over-year.

- OEM revenue of $1.0 million, down 20% year-over-year.

- Total Q1 GAAP net loss of $2.0 million versus total GAAP net loss of $5.6 million for the first quarter of 2019.

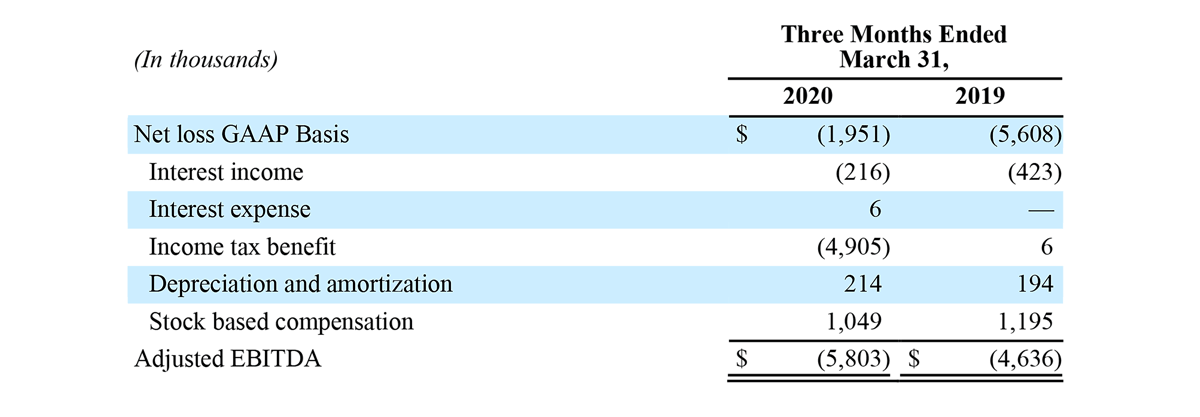

- Total Q1 adjusted EBITDA loss of $5.8 million versus adjusted EBITDA loss of $4.6 million for Q1 2019.

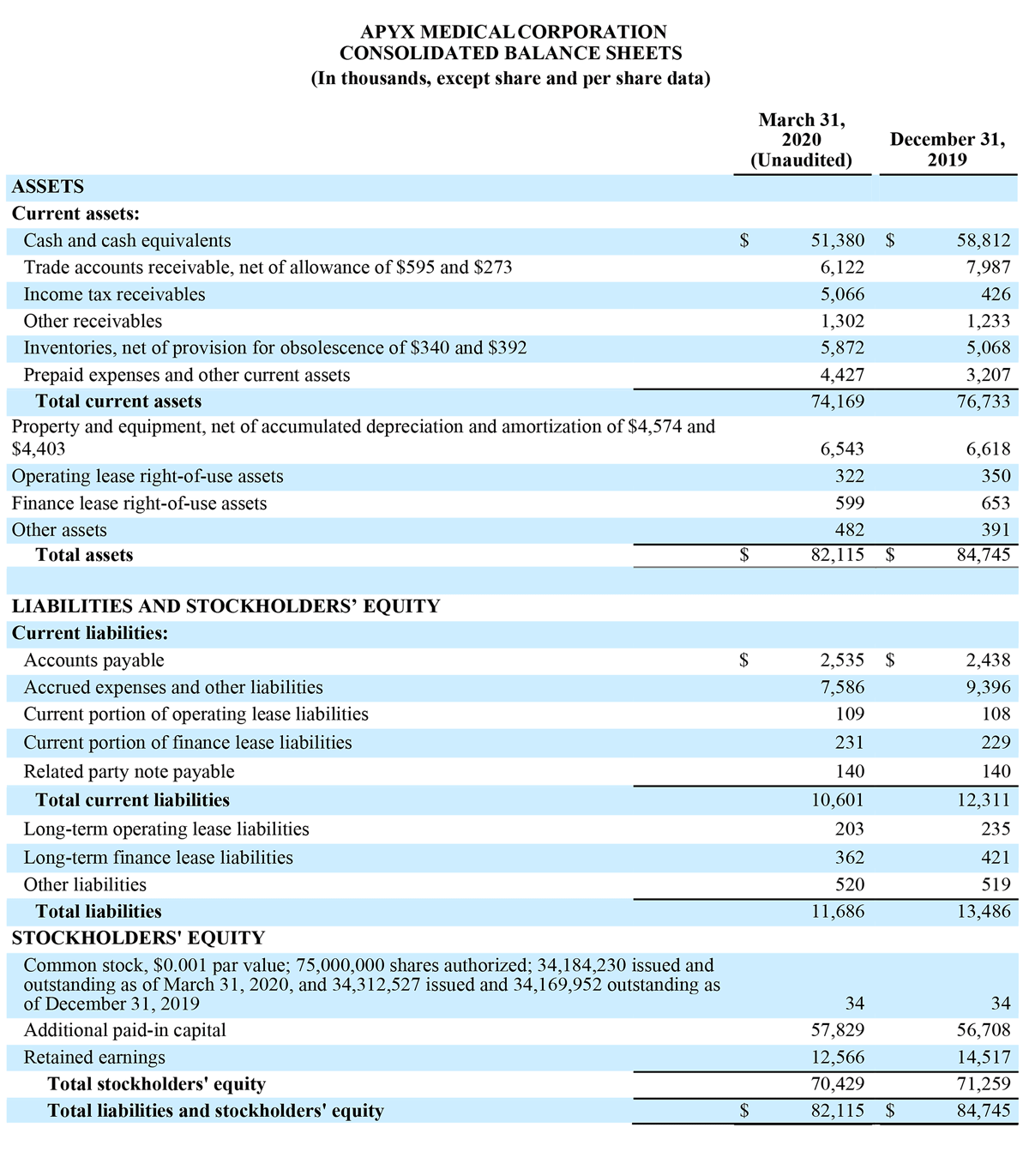

- As of March 31, 2020, the Company had cash and equivalents of $51.4 million as compared to cash and equivalents of $58.8 million as of December 31, 2019. The Company had working capital of $63.6 million as of March 31, 2020 as compared to $64.4 million as of March 31, 2019.

- On March 27, 2020, the U.S. government enacted the CARES Act to provide relief from the coronavirus pandemic. The CARES Act includes a net operating loss (NOL) provision by which the Company recognized an income tax benefit of approximately $4.9 million in the first quarter of 2020 and expects to receive a cash tax refund of approximately $3.7 million by the end of 2020. The Company expects that utilizing this provision in the CARES Act will help mitigate the financial impact of the COVID-19 pandemic.

Management Comments:

“We reported first quarter sales results at the low-end of the guidance range we provided on March 16, 2020,” said Charlie Goodwin, President and Chief Executive Officer. “While the first quarter revenue performance in our OEM business was in-line with our expectations, our revenue performance in our global Advanced Energy business was impacted significantly by the COVID-19 pandemic. Through the first two months of 2020, our Advanced Energy business was performing well with revenue up more than 30% year-over-year. Beginning in March, demand trends from our cosmetic surgery customers around the world slowed materially as a result of the preventative or protective actions taken by governments in each of our primary international markets. In the U.S., we saw a rapid deterioration in procedure trends over the last two weeks of March as states and cities implemented restrictions on elective procedures and temporary closure of non-essential businesses due to COVID-19. In response to the COVID-19 pandemic we acted quickly to protect the health and safety of our employees, patients, surgeon customers and international distributor partners around the world. We have instituted protocols intended to reduce the risk to our manufacturing employees and their families and all non-essential employees are working remotely. We have also taken preemptive steps to curtail spending, including implementing hiring restrictions, reducing most discretionary spending, reducing capital expenditures, and delaying certain R&D projects and clinical research studies. I am proud of the resolve our organization has demonstrated during these incredibly challenging times and appreciate their continued efforts to support our customers and ensure business continuity.”

Mr. Goodwin continued: “We continue to monitor the crisis caused by COVID-19 in our primary markets and, to date, the impacts of the containment efforts and the restrictions on elective procedures have had a significant impact on our global Advanced Energy sales. There is a significant amount of uncertainty as to when these actions will be lifted, and when patients will choose to undergo elective cosmetic procedures once our customers’ practices are allowed to re- open. In the interim, we have a strong balance sheet with more than $51 million in cash at quarter-end and targeted plans to reduce near-term spending in this period of business disruption that together will allow the organization to continue to build on the progress we have made in recent years to enhance this Company’s foundation for future growth. We have built a great team at Apyx Medical and we are intently focused on ensuring we are well positioned to return to executing on our growth strategy to expand our share global cosmetic surgery market as soon as the post-COVID recovery begins.”

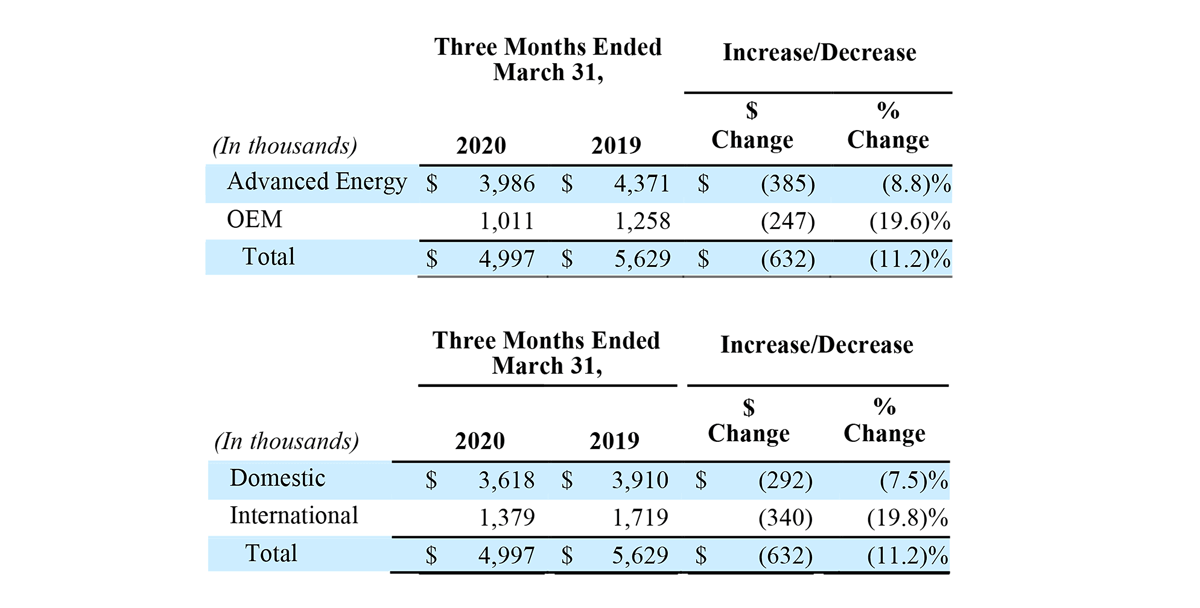

The following tables represent revenue by reportable segment (Unaudited):

First Quarter 2020 Results:

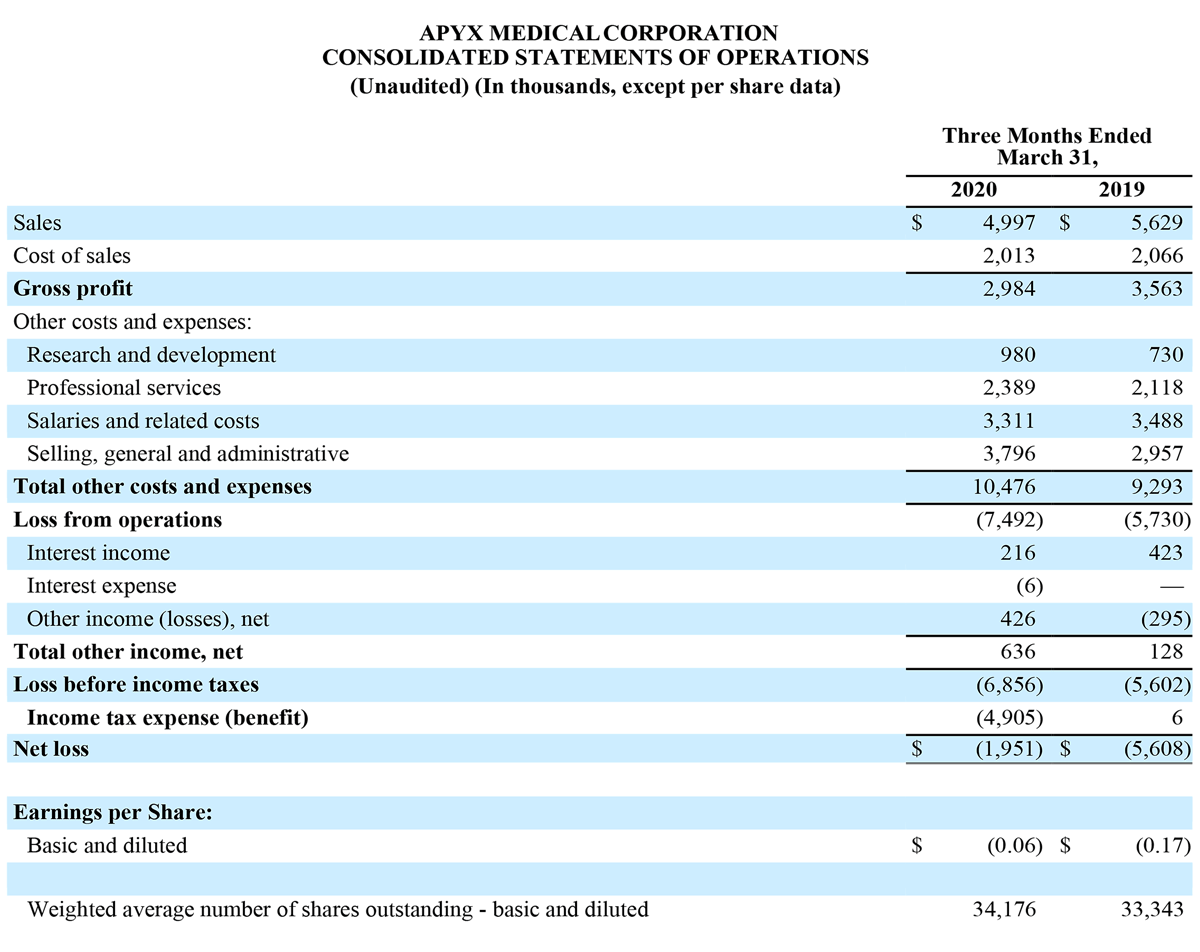

Total revenue for the three months ended March 31, 2020, decreased $0.6 million, or 11.2%, to $5.0 million, compared to $5.6 million in the prior year. Advanced Energy segment sales decreased approximately $0.4 million, or 8.8% year- over-year, to $4.0 million, compared to approximately $4.4 million last year. OEM segment sales decreased $0.2 million, or 19.6% year-over-year, to $1.0 million, compared to $1.3 million last year. For the first quarter 2020, revenue in the United States decreased $0.3 million, or 7.5% year-over-year, to $3.6 million, and international revenue decreased $0.3 million, or 19.8% year-over-year, to $1.4 million.

Gross profit for the three months ended March 31, 2020, decreased by 16.3% year-over-year, to $3.0 million, compared to $3.6 million in the prior year. Gross margin for the three months ended March 31, 2020, was 59.7%, compared to 63.3% for the same period in 2019. The primary drivers of the change in gross profit margin were product mix within both our Advanced Energy and OEM segments, revenue mix between our segments, geographical revenue mix, and improved product margins in our Advanced Energy segment as a result of our continued manufacturing efficiency initiatives.

Operating expenses for the first quarter of 2020 increased $1.2 million, or 12.7% year-over-year, to $10.5 million, compared to $9.3 million for the first quarter of 2019. The year-over-year change in operating expenses was primarily driven by a $0.8 million increase in selling, general and administrative expenses, a $0.3 million increase in research and development expenses and a $0.3 million increase in professional services, partially offset by a $0.2 million decrease in salaries and related costs.

Net loss for first quarter of 2020 was $2.0 million, or $0.06 per share, compared to a net loss of $5.6 million, or $0.17 per share, for the first quarter of 2019. The improvement was driven primarily by the Company’s income tax benefit of $4.9 million related to its provision for the carryback of net operating losses for 2019 and the first quarter of 2020.

Fiscal Year 2020 Financial Outlook:

Given the challenges and uncertainties posed by the ongoing global pandemic, the Company will not be providing full year 2020 financial guidance at this time. Assuming a more normalized business environment prevails at the time of our second quarter results conference call in August, we plan to provide updated expectations at that time.

Conference Call Details:

Management will host a conference call at 8:00 a.m. Eastern Time on May 11 to discuss the results of the quarter and to host a question and answer session. To listen to the call by phone, interested parties may dial 877-407-8289 (or 201-689-8341 for international callers) and provide access code 13701491. Participants should ask for the Apyx Medical Corporation Call. A live webcast of the call will be accessible via the Investor Relations section of the Company’s website and at:

https://78449.themediaframe.com/dataconf/productusers/apyx/mediaframe/36949/indexl.htm

A telephonic replay will be available approximately two hours after the end of the call through May 25, 2020. The replay can be accessed by dialing 877-660-6853 for U.S. callers or 201-612-7415 for international callers and using the replay access code: 13701491. The webcast will be archived on the Investor Relations section of the Company’s website.

Investor Relations Contact:

Westwicke Partners on behalf of Apyx Medical Corporation

Mike Piccinino, CFA

investor.relations@apyxmedical.com

About Apyx Medical Corporation:

Apyx Medical Corporation is an advanced energy technology company with a passion for elevating people’s lives through innovative products in the cosmetic and surgical markets. Known for its innovative Helium Plasma Technology, Apyx is solely focused on bringing transformative solutions to the physicians and patients it serves. The company’s Helium Plasma Technology is marketed and sold as Renuvion in the cosmetic surgery market and J-Plasma in the hospital surgical market. Renuvion offers plastic surgeons, fascial plastic surgeons and cosmetic physicians a unique ability to provide controlled heat to the tissue to achieve their desired results. The J-Plasma system allows surgeons to operate with a high level of precision and virtually eliminating unintended tissue trauma. The Company also leverages its deep expertise and decades of experience in unique waveforms through original equipment manufacturing (OEM) agreements with other medical device manufacturers. For further information about the Company and its products, please refer to the Apyx Medical Corporation website at www.ApyxMedical.com.

Cautionary Statement on Forward-Looking Statements:

Certain matters discussed in this release and oral statements made from time to time by representatives of the Company may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the Federal securities laws. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved.

Forward-looking information is subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Many of these factors are beyond the Company’s ability to control or predict. Important factors that may cause actual results to differ materially and that could impact the Company and the statements contained in this release can be found in the Company’s filings with the Securities and Exchange Commission including the Company’s Report on Form 10-K for the year ended December 31, 2019. For forward-looking statements in this release, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise.

APYX MEDICAL CORPORATION

RECONCILIATION OF GAAP NET LOSS RESULTS TO NON-GAAP ADJUSTED EBITDA

(Unaudited) (In thousands)

Use of Non-GAAP Financial Measures

We present these non-GAAP measures because we believe these measures are useful indicators of our operating performance. Our management uses these non-GAAP measures principally as a measure of our operating performance and believes that these measures are useful to investors because they are frequently used by analysts, investors and other interested parties to evaluate companies in our industry. We also believe that these measures are useful to our management and investors as a measure of comparative operating performance from period to period.

The Company has presented the following non-GAAP financial measures in this press release: adjusted EBITDA. The Company defines adjusted EBITDA as its reported net income/(loss) (GAAP) plus income tax expense, interest, depreciation and amortization, and stock-compensation expense.