BOVIE MEDICAL CORPORATION REPORTS SECOND QUARTER 2018 FINANCIAL RESULTS

Advanced Energy Sales of $3.1 million in Q2, up 72% year-over-year

CLEARWATER, FL — AUGUST 1, 2018 – Bovie Medical Corporation (NYSEMKT:BVX) (the “Company”), a maker of medical devices and supplies and the developer of J-Plasma®, a patented surgical product marketed and sold under the Renuvion™ Cosmetic Technology brand in the cosmetic surgery market, today reported financial results for its second quarter ended June 30, 2018.

Second Quarter 2018 Financial Summary:

- Total Q2 revenue of approximately $11.5 million, up 17% year-over-year.

- Advanced Energy revenue of $3.1 million, up 72% year-over-year, driven by strong J-Plasma/Renuvion sales.

- Core revenue of approximately $7.8 million, up 4% year-over-year.

- OEM revenue of approximately $0.6 million, up 16% year-over-year.

- Total Q2 adjusted EBITDA of approximately $0.3 million versus adjusted EBITDA loss of approximately $0.9 million for the second quarter of 2017.

Second Quarter 2018 Operating Highlights:

- On May 1st, the Company announced the appointment of Diane I. Duncan, M.D., FACS, a Board-certified plastic surgeon, to the Company’s Medical Advisory Board.

- On May 14th, the Company announced the completion of enrollment in the U.S. Investigational Device Exemption (IDE) clinical study of its J-Plasma/Renuvion technology for use in dermal skin resurfacing.

Operating Highlights Subsequent to Quarter-End:

- On July 9th, the Company announced it has entered into a definitive agreement with Specialty Surgical Instrumentation Inc., a subsidiary of Symmetry Surgical Inc. (“Symmetry”), pursuant to which the Company will divest and sell the Core business segment and the Bovie® brand to Symmetry for gross proceeds of $97 million in cash. The asset purchase agreement was approved by the Company’s Board of Directors and is subject to customary closing conditions – including approval by the Company’s stockholders. The transaction is expected to close in the third quarter of 2018.

Annual Stockholders’ Meeting:

- The Annual Meeting is scheduled to be held on August 30, 2018 at 10:00 a.m. Eastern Standard Time at the offices of Ruskin Moscou Faltischek, P.C., located at East Tower, 15th Floor, 1425 RXR Plaza, Uniondale, New York 11556.

Management Comments:

“Bovie Medical is pleased to report another quarter of impressive financial performance and exciting operational progress,” said Charlie Goodwin, Chief Executive Officer. “We experienced strong growth in our Advanced Energy business, which was marked by continued strength in both adoption and utilization of our J-Plasma/Renuvion technology. The trends we saw in our Advanced Energy business continue to confirm our strategic focus on the U.S. cosmetic surgery market, where our hybrid sales force is driving adoption of our Renuvion Cosmetic Technology. Building on the strong Advanced Energy growth in the U.S., we also saw strong demand for our J-Plasma/Renuvion technology from our network of distribution partners outside the U.S. in the second quarter.”

Mr. Goodwin continued: “We complemented our second quarter financial performance by achieving a number of important operational milestones related to our longer-term growth strategy to create a foundation of support for our Renuvion technology that will encourage its broader adoption in the cosmetic surgery market going forward. Specifically, we completed enrollment in our U.S. IDE clinical study evaluating the use of Renuvion Technology for dermal resurfacing procedures. This study represents an exciting first step in our efforts to establish strong clinical support demonstrating the positive outcomes that can be achieved by using Renuvion technology. Furthermore, the results from the dermal resurfacing U.S. IDE clinical study will support our 510(k) submission to the FDA for a new indication to market and sell Renuvion for dermal resurfacing procedures.”

“We also made progress towards our strategic goal of enhancing physician and practice support for our cosmetic surgery customers with the launch of Renuvion Cosmetic Technology, a new dedicated brand for our J-Plasma generators and hand pieces in the cosmetic surgery market. This represents an important launch for our Company, as Renuvion Cosmetic Technology demonstrates our strong commitment to physician customers in the cosmetic surgery market by providing them with a brand that was specifically designed to resonate with their patients. Simply stated, the early market response to the Renuvion launch has exceeded our expectations and we could not be happier with positive feedback we have received from our physician customers. Finally, we enhanced our Medical Advisory Board with the appointment of Dr. Diane Duncan, the second expert from the cosmetic surgery market to join our MAB, who along with Dr. Jack Zamora will provide advice and guidance on our long-term clinical and commercial strategies.”

“In addition to the strong operating and financial results we achieved over the first six months of 2018, on July 9th, we announced the divestment and sale of our Core business segment to Specialty Surgical Instrumentation, Inc., a subsidiary of Symmetry Surgical, Inc. We believe this announcement represents a watershed event for our Company; one that we believe is beneficial for all Bovie Medical constituents: our Core business segment customers, our employees and our stockholders. This transaction allows us to focus on our largest, fastest growing market opportunity by leveraging our highly-differentiated J-Plasma/Renuvion technology with the potential to achieve attractive outcomes for physicians and their patients in the cosmetic surgery market. The proceeds from this transaction will significantly enhance our balance sheet, allowing us to pursue this strategy and ultimately achieve strong, sustained and profitable growth for the benefit of our stockholders.”

“As we enter the second half of 2018, we remain focused on executing against our strategic objectives in our Advanced Energy business and expect continued strong adoption of our Renuvion Technology to be the primary driver of growth this year. The transaction with Symmetry is expected to close during the third quarter and following the closing, we plan to host a call with the investment community to update our fiscal year 2018 financial guidance and to share more details about the growth and profitability profile of the remaining Advanced Energy and OEM businesses going forward.”

Second Quarter 2018 Results:

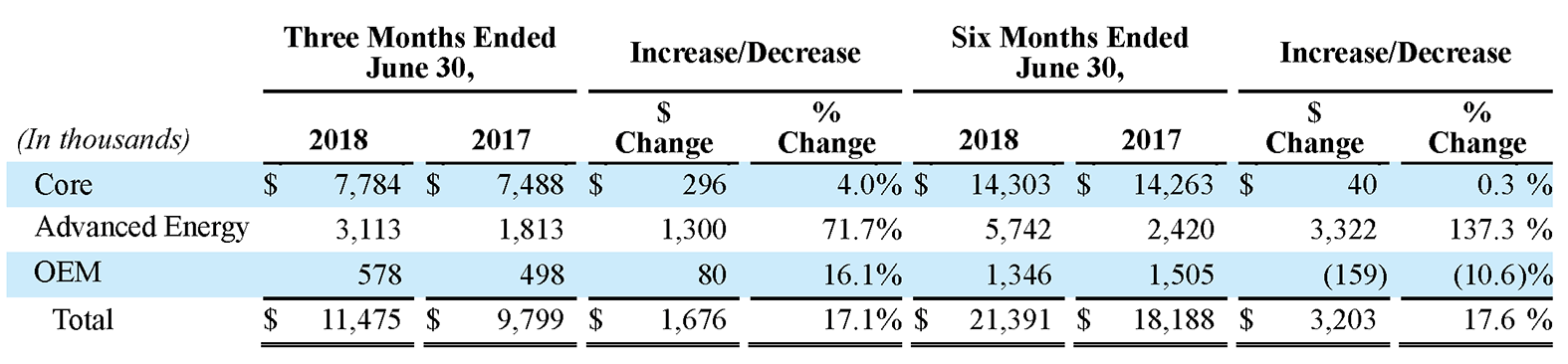

The following table represents revenue by reportable segment:

Total revenue for second quarter 2018 increased $1.7 million, or 17.1%, to $11.5 million, compared to $9.8 million in the second quarter of 2017. Sales of the Company’s J-Plasma/Renuvion generators and handpieces were the primary driver of the increase in total revenue in second quarter 2018, with growth in Core and OEM segment sales contributing modestly to the year-over-year increase in total revenue as well during the second quarter 2018 period. Advanced Energy segment sales increased approximately $1.3 million, or 71.7% year-over-year, to $3.1 million, compared to approximately $1.8 million last year. Core segment sales increased approximately $0.3 million, or 4.0% year-over-year, to $7.8 million, compared to approximately $7.5 million last year. OEM segment sales increased $0.1 million, or 16.1% year-over-year, to $0.6 million, compared to $0.5 million last year.

Total revenue for second quarter 2018 increased $1.7 million, or 17.1%, to $11.5 million, compared to $9.8 million in the second quarter of 2017. Sales of the Company’s J-Plasma/Renuvion generators and handpieces were the primary driver of the increase in total revenue in second quarter 2018, with growth in Core and OEM segment sales contributing modestly to the year-over-year increase in total revenue as well during the second quarter 2018 period. Advanced Energy segment sales increased approximately $1.3 million, or 71.7% year-over-year, to $3.1 million, compared to approximately $1.8 million last year. Core segment sales increased approximately $0.3 million, or 4.0% year-over-year, to $7.8 million, compared to approximately $7.5 million last year. OEM segment sales increased $0.1 million, or 16.1% year-over-year, to $0.6 million, compared to $0.5 million last year.

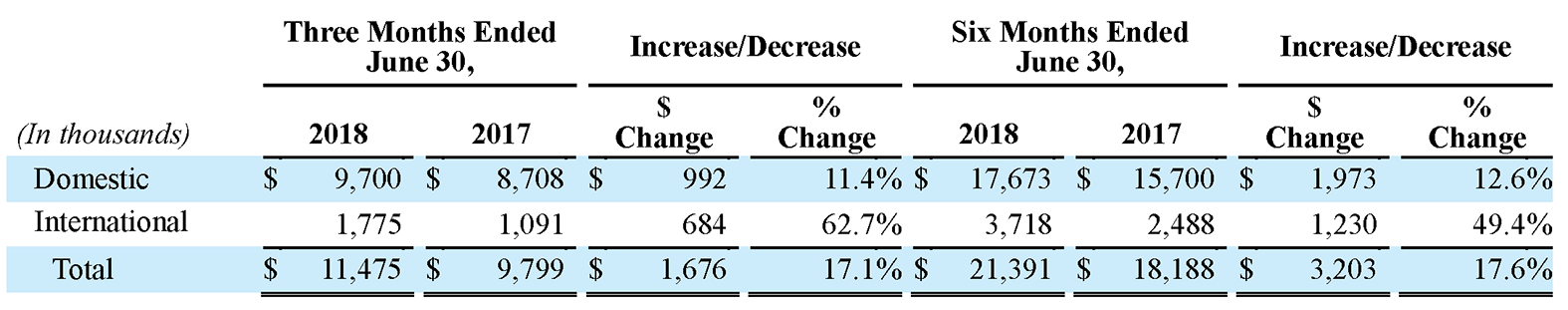

Revenue in the United States increased approximately $1.0 million, or 11.4% year-over-year, to $9.7 million, and international revenue increased approximately $0.7 million, or 62.7% year-over-year, to $1.8 million. International sales growth in the second quarter was primarily driven by sales to international distributors in the Company’s Advanced Energy segment.

Revenue in the United States increased approximately $1.0 million, or 11.4% year-over-year, to $9.7 million, and international revenue increased approximately $0.7 million, or 62.7% year-over-year, to $1.8 million. International sales growth in the second quarter was primarily driven by sales to international distributors in the Company’s Advanced Energy segment.

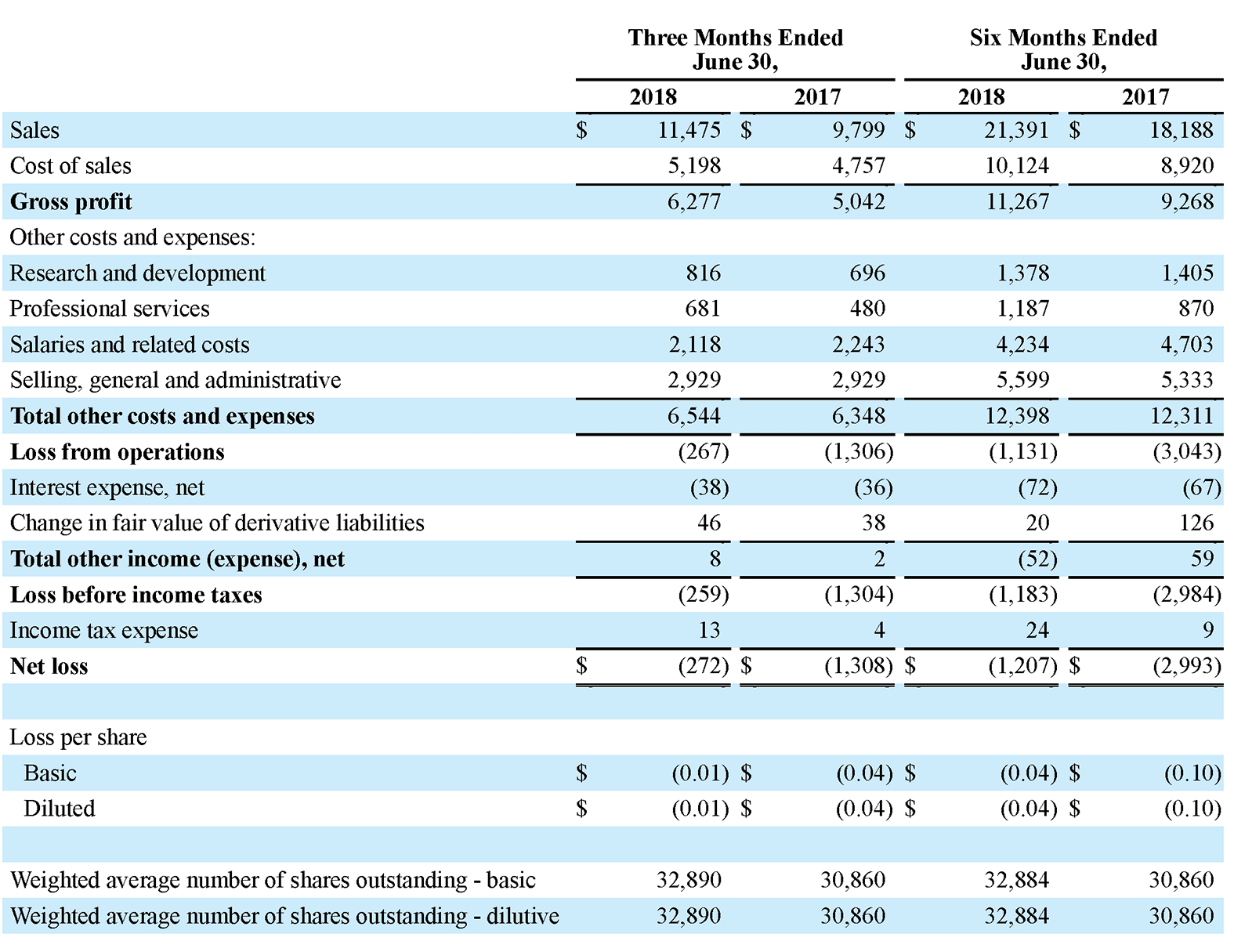

Gross profit for the second quarter of 2018 increased approximately $1.2 million, or 24.5% year-over-year, to $6.3 million, compared to $5.0 million for second quarter of 2017. The primary drivers of the increase were favorable manufacturing variances partially offset by lower margins in the Advanced Energy segment attributable to product mix.

Operating expenses for the second quarter of 2018 increased approximately $0.2 million, or 3.1% year-over-year, to $6.5 million, compared to $6.3 million for the second quarter of 2017. The year-over-year change in operating expenses was primarily driven by a $0.2 million increase in professional services expense and a $0.1 million increase in research and development expenses, offset partially by a $0.1 million decrease in salaries and related expense.

Loss from operations for second quarter 2018 was $0.3 million, compared to a loss from operations of $1.3 million for the comparable period last year.

Net loss for second quarter 2018 was $0.3 million, or $0.01 per diluted share, compared to a loss of $1.3 million, or $0.04 per diluted share, for the second quarter of 2017.

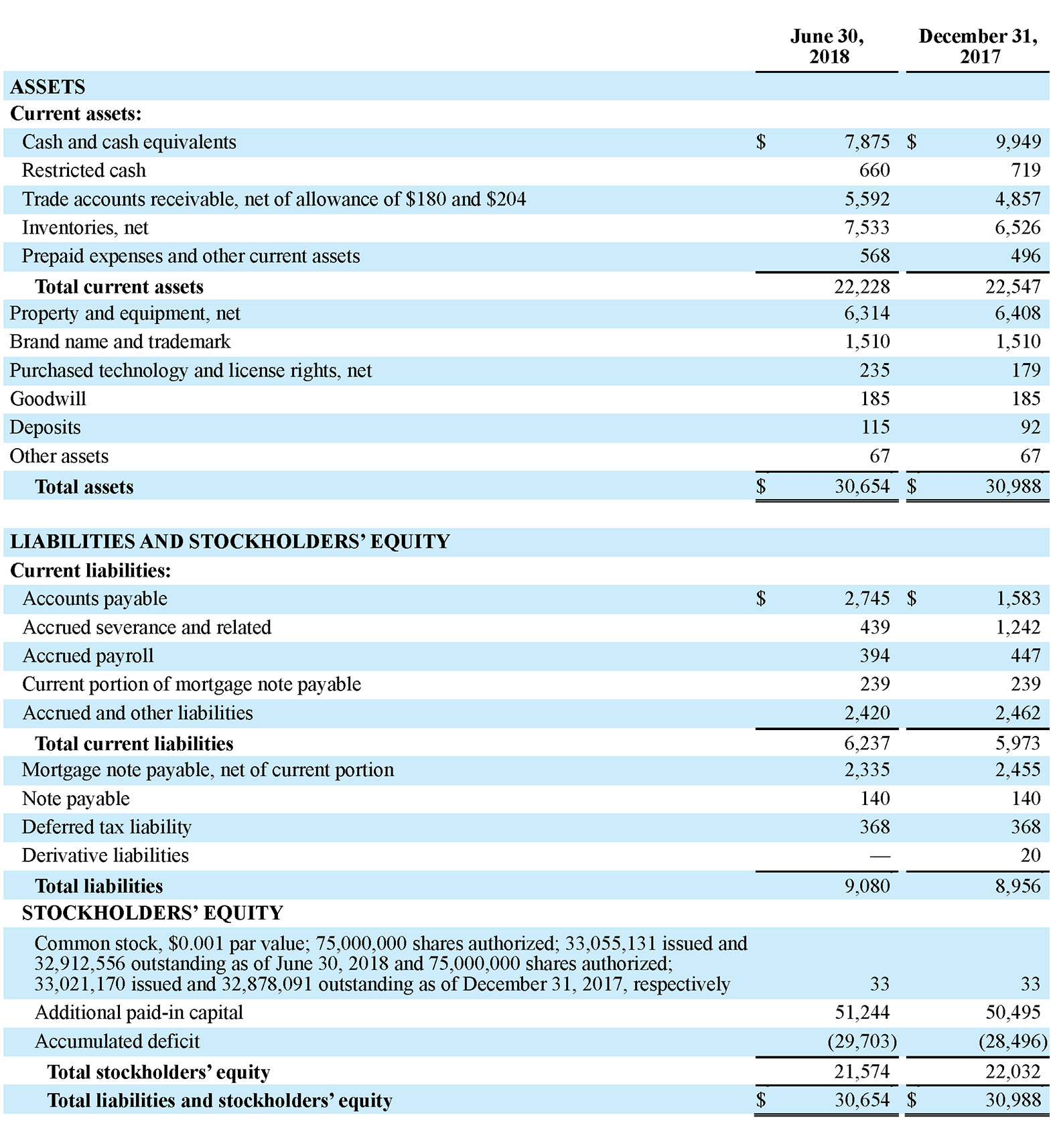

As of June 30, 2018, the Company had cash and equivalents of $8.5 million as compared to $10.7 million as of December 31, 2017. The Company had working capital of $16.0 million as of June 30, 2018 as compared to $16.6 million as of December 31, 2017.

Six Months 2018 Results:

Total revenue for the six months ended June 30, 2018 increased $3.2 million, or 17.6%, to $21.4 million, compared to $18.2 million in the six months ended June 30, 2017. Total revenue growth was driven by a 137.3% increase in Advance Energy sales and a 0.3% increase in Core sales, and was partially offset by a 10.6% decrease in OEM sales.

Net loss for the six months ended June 30, 2018 was $1.2 million, or $0.04 per diluted share, compared to a loss of $3.0 million, or $0.10 per diluted share, for the six months ended June 30, 2017.

2018 Outlook:

The Company plans to update its financial guidance for fiscal year 2018 following the close of the divestment and sale of the Core business segment to Specialty Surgical Instrumentation, Inc., a subsidiary of Symmetry Surgical, Inc. which is expected to occur in the third quarter of 2018.

Investor Relations Contact:

Westwicke Partners on behalf of Bovie Medical Corporation

Mike Piccinino, CFA

443-213-0500

investor.relations@boviemed.com

About Bovie Medical Corporation:

Bovie Medical Corporation is a leading maker of medical devices and supplies as well as the developer of J-Plasma® (marketed and sold under the Renuvion™ Cosmetic Technology brand in the cosmetic surgery market), a patented plasma-based surgical product for cutting, coagulation and ablation of soft tissue. J-Plasma/Renuvion technology utilizes a helium ionization process to produce a stable, focused beam of plasma that provides surgeons with greater precision, and minimal invasiveness. The new J-Plasma/Renuvion handpieces with Cool-Coag™ technology deliver the precision of helium plasma energy, the power of traditional monopolar coagulation and the efficiency of plasma beam coagulation – enabling thin-layer ablation and dissection and fast coagulation with a single instrument, minimizing instrument exchange and allowing a surgeon to focus on their patient and their procedures. With Cool-Coag technology, the new J-Plasma/Renuvion handpieces can deliver three distinctly different energy modalities – further increasing the utility and versatility of the system. Bovie Medical Corporation is also a leader in the manufacture of a range of electrosurgical products and technologies, marketed through both private labels and the Company’s own well-respected brands (Bovie®, IDS™ and DERM™) to distributors worldwide. The Company also leverages its expertise through original equipment manufacturing (OEM) agreements with other medical device manufacturers. For further information about the Company and its products, please refer to the Bovie Medical Corporation website at www.boviemedical.com.

Cautionary Statement on Forward-Looking Statements:

Certain matters discussed in this release and oral statements made from time to time by representatives of the Company may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the Federal securities laws. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved.

Forward-looking information is subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Many of these factors are beyond the Company’s ability to control or predict. Important factors that may cause actual results to differ materially and that could impact the Company and the statements contained in this release can be found in the Company’s filings with the Securities and Exchange Commission including the Company’s Report on Form 10-K for the year ended December 31, 2017 and subsequent Form 10-Q filings. For forward-looking statements in this release, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise.

BOVIE MEDICAL CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited) (In thousands, except per share data)

BOVIE MEDICAL CORPORATION CONSOLIDATED BALANCE SHEETS

BOVIE MEDICAL CORPORATION CONSOLIDATED BALANCE SHEETS

(Unaudited) (In thousands, except share and per share data)

BOVIE MEDICAL CORPORATION

BOVIE MEDICAL CORPORATION

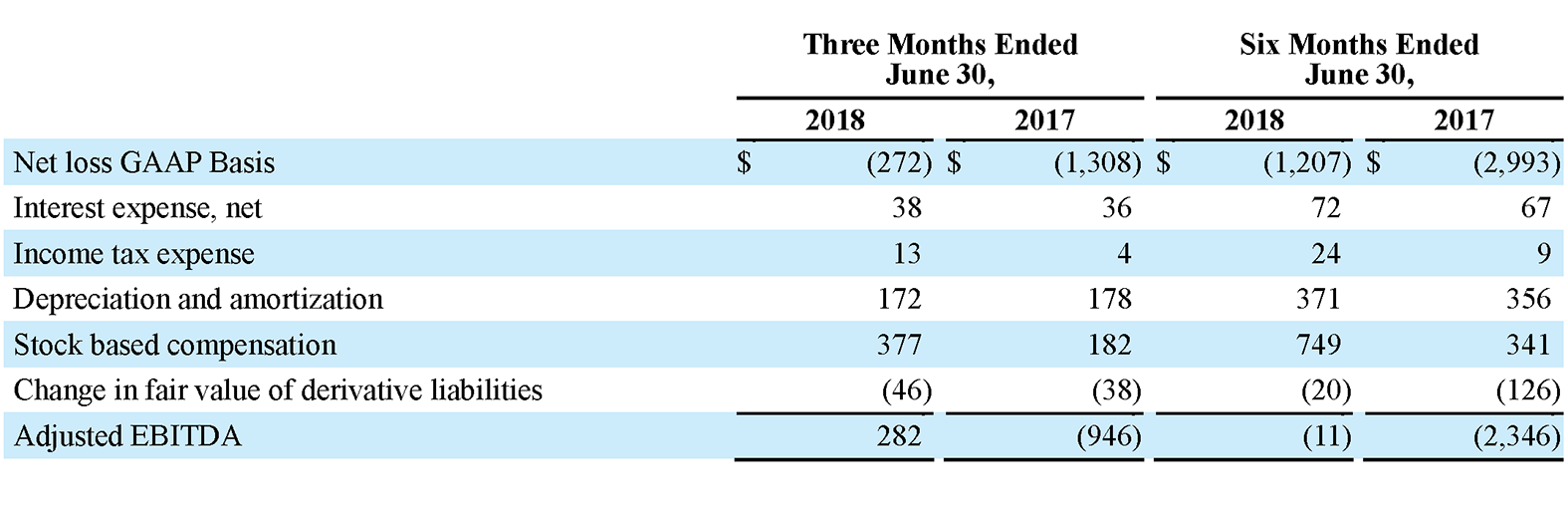

RECONCILIATION OF GAAP NET INCOME/(LOSS) RESULTS TO NON-GAAP ADJUSTED EBITDA/(LOSS)

(Unaudited) (In thousands)

Use of Non-GAAP Financial Measures

We present these non-GAAP measures because we believe these measures are useful indicators of our operating performance. Our management uses these non-GAAP measures principally as a measure of our operating performance and believes that these measures are useful to investors because they are frequently used by analysts, investors and other interested parties to evaluate companies in our industry. We also believe that these measures are useful to our management and investors as a measure of comparative operating performance from period to period.

The Company has presented the following non-GAAP financial measures in this press release: adjusted EBITDA. The Company defines adjusted EBITDA as its reported net income/(loss) (GAAP) plus income tax expense, interest expense, net, depreciation and amortization, stock-compensation expense, and changes in value of derivative liabilities.