BOVIE MEDICAL CORPORATION REPORTS THIRD QUARTER 2017 FINANCIAL RESULTS AND UPDATES FISCAL YEAR 2017 FINANCIAL OUTLOOK

Advanced Energy Sales of $2.1 million in Q3, up 52.0% year-over-year, driven by strong J-Plasma® sales.

CLEARWATER, FL — NOVEMBER 2, 2017 – Bovie Medical Corporation (BVX) (the “Company”), a maker of medical devices and supplies and the developer of J-Plasma®, a patented new surgical product, today reported financial results for its third fiscal quarter ended September 30, 2017.

Third Quarter 2017 Financial Summary:

- Advanced Energy revenue of $2.1 million, up 52% year-over-year, driven by strong J-Plasma®

- Advanced Energy revenue increased 17% quarter-over-quarter in Q3.

- Core revenue of approximately $6.7 million, down 3% year-over-year.

- Management believes core segment revenue was impacted by hurricane-related business disruptions in Texas and Florida during the third quarter.

- OEM revenue of approximately $0.5 million, down 70.2% year-over-year.

- Total Q3 revenue of approximately $9.3 million, down 7.1% year-over-year.

- Total Q3 adjusted EBITDA loss of approximately $772,000 versus adjusted EBITDA of approximately $129,000 in the third quarter of 2016.

- Q3 adjusted EBITDA loss includes approximately $370,000 of expenses related to an inventory write-down in the period.

Management Comments:

“We experienced another quarter of strong growth in sales in our Advanced Energy segment during the third quarter, with sales increasing 52% year-over-year and 17% sequentially, fueled by strong adoption and utilization of our J-Plasma® products,” said Robert L. Gershon, Chief Executive Officer. “While we remain in the early stages of driving sales into our target markets of plastic surgery and surgical oncology, we are encouraged by the consistently positive feedback that we have received from both new and existing customers, and continue to believe that the features and benefits of this innovative technology are resonating well within these two areas of the surgeon community.”

Mr. Gershon continued: “We believe our third quarter revenue was impacted by business disruptions related to the hurricanes in Texas and Florida in August and September. These are important areas of the U.S. for our Core segment. In addition to the sales disruption in Texas and Florida during the period, we experienced temporary disruptions in our business operations.”

Mr. Gershon further stated: “We are updating our 2017 guidance expectations to account for stronger growth in our Advanced Energy segment – we now expect growth of 93%–98% year over year in Advanced Energy sales in 2017, offset by lower expectations from the Core segment.”

Third Quarter 2017 Results:

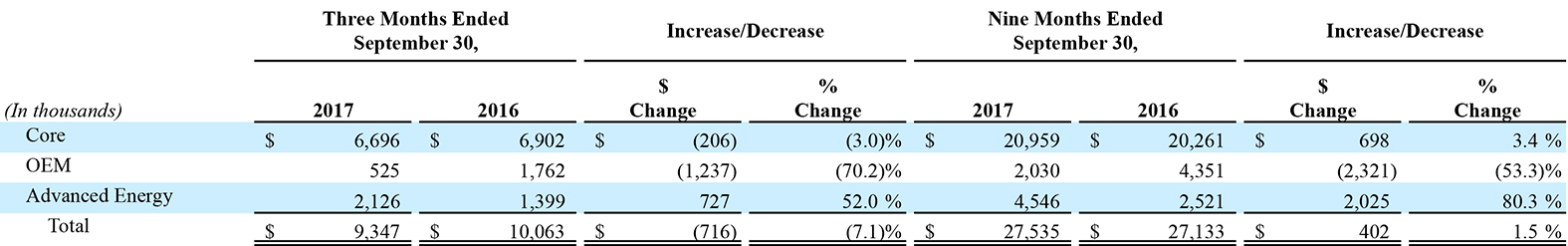

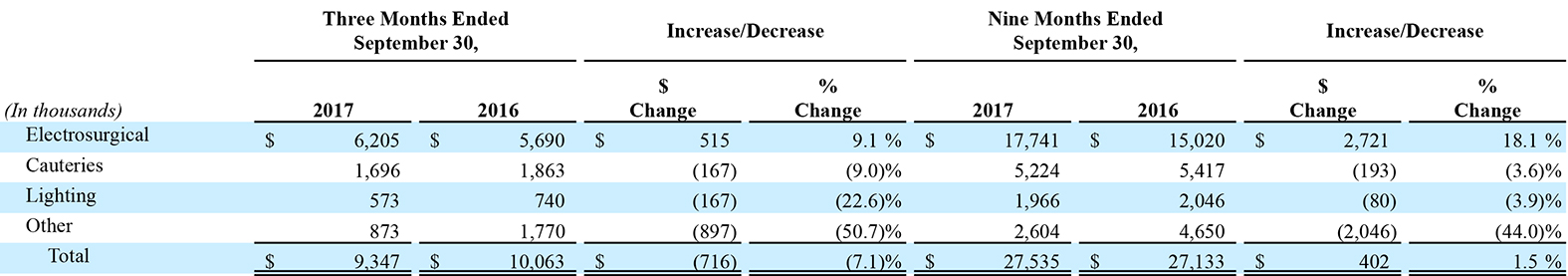

The following tables represent revenue by reportable segment and by product line:

Total revenue for third quarter 2017 decreased $0.7 million, or 7.1%, to $9.3 million, compared to $10.1 million in the third quarter of 2016. Advanced Energy segment sales, nearly all of which are from sales of J-Plasma products, increased approximately $0.7 million, or 52.0% year-over-year, to $2.1 million, compared to approximately $1.4 million last year. The strong Advanced Energy growth in the third quarter was offset by year-over-year declines in revenue from the OEM and Core segments of 70.2% and 3.0%, respectively. The decrease in OEM sales year-over-year was in-line with the Company’s guidance expectations which assumed the impact of lower production demand from customers compared to last year. Management believes Core sales were negatively impacted by hurricane–related business disruptions in Texas and Florida during the third quarter.

Total revenue for third quarter 2017 decreased $0.7 million, or 7.1%, to $9.3 million, compared to $10.1 million in the third quarter of 2016. Advanced Energy segment sales, nearly all of which are from sales of J-Plasma products, increased approximately $0.7 million, or 52.0% year-over-year, to $2.1 million, compared to approximately $1.4 million last year. The strong Advanced Energy growth in the third quarter was offset by year-over-year declines in revenue from the OEM and Core segments of 70.2% and 3.0%, respectively. The decrease in OEM sales year-over-year was in-line with the Company’s guidance expectations which assumed the impact of lower production demand from customers compared to last year. Management believes Core sales were negatively impacted by hurricane–related business disruptions in Texas and Florida during the third quarter.

By product line, sales of electrosurgical, cauteries, lighting and other products represented 67% 18%, 6% and 9% of total revenue, respectively, for the three months ended September 30, 2017. The largest product line contributor to total revenue growth in the third quarter of 2017 was a 9.1% increase in sales of electrosurgical products, driven primarily by Advanced Energy sales.

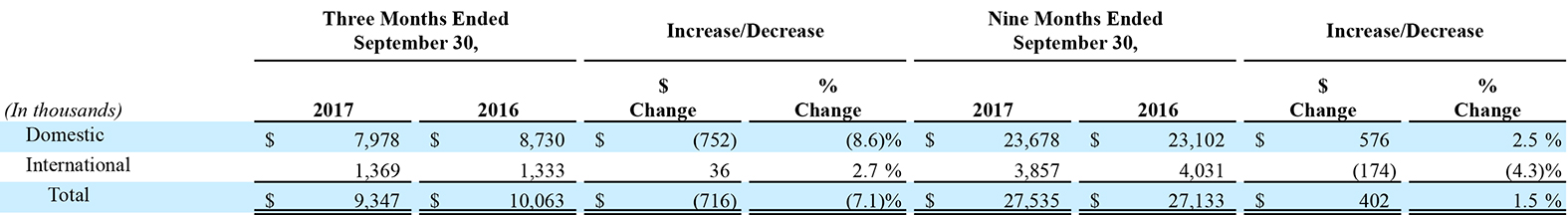

Revenue in the United States decreased $0.8 million, or 8.6% year-over-year, to $8.0 million, and international revenue increased approximately $36,000, or 2.7% year-over-year, to $1.4 million.

Revenue in the United States decreased $0.8 million, or 8.6% year-over-year, to $8.0 million, and international revenue increased approximately $36,000, or 2.7% year-over-year, to $1.4 million.

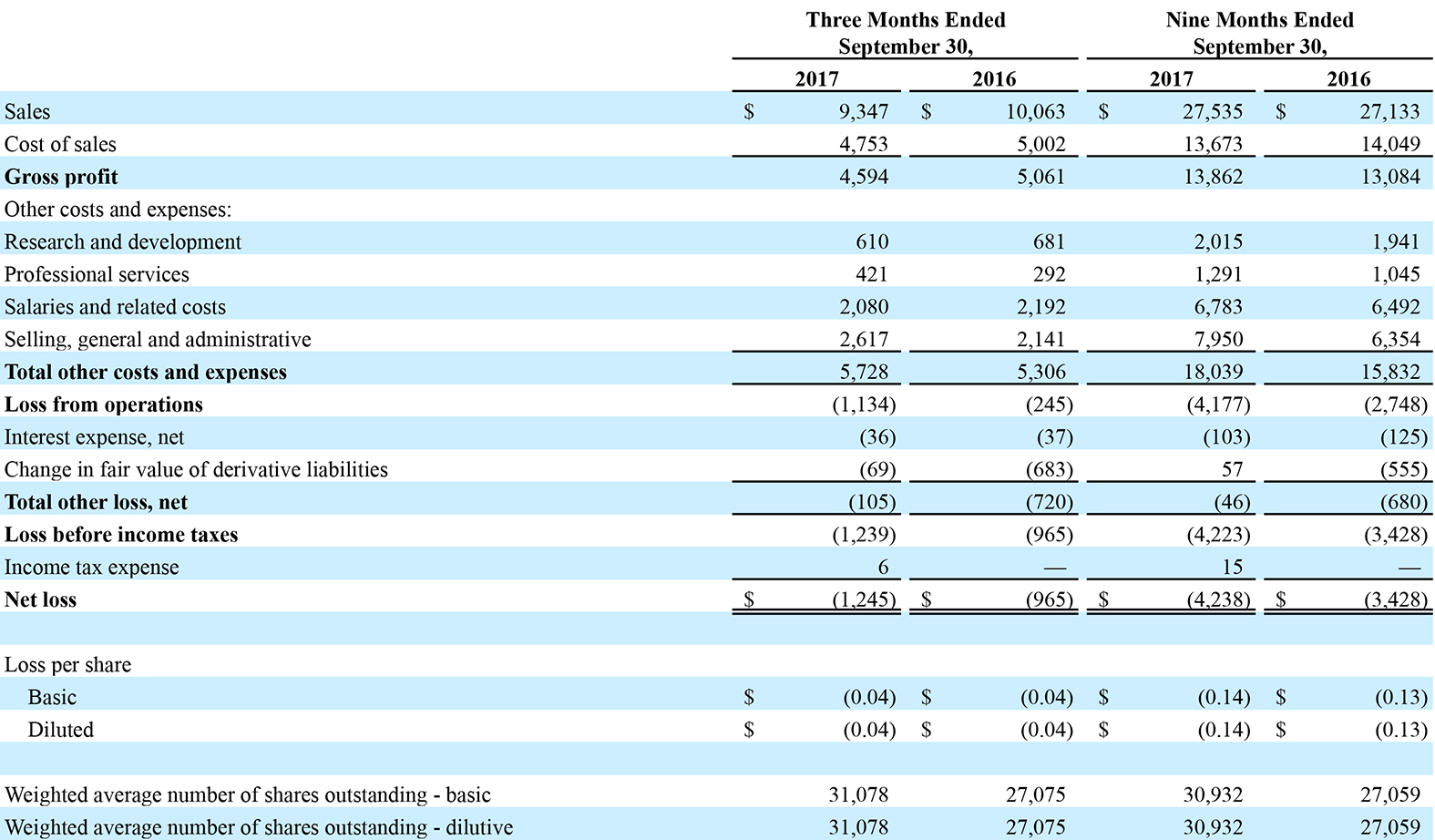

Gross profit for the third quarter of 2017 decreased $0.5 million, or 9.2% year-over-year, to $4.6 million, compared to $5.1 million for third quarter 2016. Gross margin decreased approximately 120 basis points year-over-year to 49.1% for the third quarter of 2017, compared to 50.3% last year. Third quarter gross margins were negatively impacted due to a write down of approximately $370,000 for obsolete inventory related to the Company’s first generation J-Plasma products, which have been substantially upgraded to the current product generation. The decrease in gross margin was partially offset by higher margins in the Advanced Energy segment.

Operating expenses for third quarter 2017 increased $0.4 million, or 8.0% year-over-year, to $5.7 million, compared to $5.3 million for third quarter 2016. The increase in operating expenses was primarily driven by a $0.5 million increase in selling, general and administrative expenses over the comparable period last year.

Loss from operations for the third quarter of 2017 was $1.1 million, compared to a loss from operations of $0.2 million for the comparable period last year.

Net loss attributed to common shareholders for the third quarter of 2017 was $1.2 million, or $0.04 per diluted share, compared to a loss of $1.0 million, or $0.04 per diluted share, for the third quarter of 2016.

As of September 30, 2017, the Company had cash and equivalents of $10.2 million as compared to $15.2 million as of December 31, 2016. The Company had working capital of $17.4 million as of September 30, 2017 as compared to $21.3 million as of December 31, 2016.

Nine Months 2017 Results:

Total revenue for the nine months ended September 30, 2017 increased $0.4 million, or 1.5%, to $27.5 million, compared to $27.1 million in the nine months ended September 30, 2016. Total revenue growth was driven by an 80.3% increase in Advance Energy sales and a 3.4% increase in Core sales, and was partially offset by a 53.3% decrease in OEM sales.

Net loss attributed to common shareholders for the nine months ended September 30, 2017 was $4.2 million, or $0.14 per diluted share, compared to a loss of $3.4 million, or $0.13 per diluted share, for nine months ended September 30, 2016.

2017 Outlook:

The Company now expects total revenue in the range of $37.9 million to $38.4 million, representing growth of 4% to 5% year-over-year, compared to prior guidance which assumed growth in the range of approximately 5% to 11% year-over-year.

- The Company expects total revenue growth to be driven by:

- Advanced Energy sales growth in the range of approximately 93% to 98% year-over-year as compared to growth in the range of approximately 90% to 95% year-over-year previously,

- OEM sales decline in the range of approximately 50% to 55% year-over-year, unchanged from prior guidance expectations.

- Core sales growth in the range of approximately 3% to 4% year-over-year, as compared to growth in the range of approximately 5% to 11% year-over-year previously.

- The Company now expects adjusted EBITDA loss in a range of $2.8 million to $3.0 million, compared to adjusted EBITDA loss in a range of $1.2 to $1.4 million in our prior guidance range.

- The new adjusted EBITDA loss range for fiscal year 2017 includes the impacts of an inventory write-down in the third quarter as well as the impacts from lower core sales and higher operating costs.

Conference Call Details:

Management will host a conference call at 4:30 p.m. Eastern Time on November 2, 2017 to discuss the results of the quarter and host a question and answer session. To listen to the call by phone, interested parties within the U.S. may dial 844-507-6493 (or 647-253-8641 for international callers) and provide access code 95898318. Participants should ask for the Bovie Medical Corporation Call. A live webcast of the call will be accessible via the Investor Relations section of the Company’s website and at:

https://event.on24.com/wcc/r/1472820/04D7A7087BD18CA1B64C4A121242427B

A telephonic replay will be available approximately two hours after the end of the call through November 16, 2017. The replay can be accessed by dialing 800-585-8367 for U.S. callers or 416-621-4642 for International callers and using the replay access code: 95898318. The webcast will be archived on the Investor Relations section of the Company’s website.

Investor Relations Contact:

Westwicke Partners on behalf of Bovie Medical Corporation

Mike Piccinino, CFA

Managing Director

443-213-0500

investor.relations@boviemed.com

About Bovie Medical Corporation:

Bovie Medical Corporation is a leading maker of medical devices and supplies as well as the developer of J-Plasma®, a patented plasma-based surgical product for cutting, coagulation and ablation of soft tissue. J-Plasma® utilizes a helium ionization process to produce a stable, focused beam of plasma that provides surgeons with greater precision, minimal invasiveness and an absence of conductive currents through the patient during surgery. The new J-Plasma® handpieces with Cool-Coag™ technology deliver the precision of helium plasma energy, the power of traditional monopolar coagulation and the efficiency of plasma beam coagulation – enabling thin-layer ablation and dissection and fast coagulation with a single instrument, minimizing instrument exchange and allowing a surgeon to focus on their patient and their procedures. With Cool-Coag technology, the new J-Plasma handpieces can deliver three distinctly different energy modalities – further increasing the utility and versatility of the J-Plasma system. Bovie Medical Corporation is also a leader in the manufacture of a range of electrosurgical products and technologies, marketed through both private labels and the Company’s own well-respected brands (Bovie®, IDS™ and DERM™) to distributors worldwide. The Company also leverages its expertise through original equipment manufacturing (OEM) agreements with other medical device manufacturers. For further information about the Company’s current and new products, please refer to the Investor Relations section of Bovie Medical Corporation at www.boviemedical.com.

Cautionary Statement on Forward-Looking Statements:

Certain matters discussed in this release and oral statements made from time to time by representatives of the Company may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the Federal securities laws. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved.

Forward-looking information is subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Many of these factors are beyond the Company’s ability to control or predict. Important factors that may cause actual results to differ materially and that could impact the Company and the statements contained in this release can be found in the Company’s filings with the Securities and Exchange Commission including the Company’s Report on Form 10-K for the year ended December 31, 2016 and subsequent Form 10-Q filings. For forward-looking statements in this release, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise.

BOVIE MEDICAL CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited) (In thousands, except per share data)

BOVIE MEDICAL CORPORATION

CONSOLIDATED BALANCE SHEETS

(Unaudited) (In thousands, except share and per share data)

BOVIE MEDICAL CORPORATION

RECONCILIATION OF GAAP NET INCOME/(LOSS) RESULTS TO NON-GAAP ADJUSTED EBITDA/(LOSS)

(Unaudited) (In thousands)

Use of Non-GAAP Financial Measures

We present these non-GAAP measures because we believe these measures are useful indicators of our operating performance. Our management uses these non-GAAP measures principally as a measure of our operating performance and believes that these measures are useful to investors because they are frequently used by analysts, investors and other interested parties to evaluate companies in our industry. We also believe that these measures are useful to our management and investors as a measure of comparative operating performance from period to period.

The Company has presented the following non-GAAP financial measures in this press release: adjusted EBITDA. The Company defines adjusted EBITDA as its reported net income/(loss) (GAAP) plus income tax expense, interest expense, net, depreciation and amortization, stock-compensation expense, and changes in value of derivative liabilities.

The following unaudited table presents a reconciliation of net loss to Adjusted EBITDA for our 2017 guidance:

The reconciliation assumes the mid-point of the Adjusted EBITDA loss range and the midpoint of each component of the reconciliation, corresponding to guidance of $2.8 million to $3.0 million for 2017.